Take the Risk and Confusion Out of TAX COMPLIANCE

What you need to know about medical reimbursement plans and 105(h) compliance

What you need to know about medical reimbursement plans and 105(h) compliance

When it comes to medical reimbursement plans, asking the right questions is key to ensuring compliance and avoiding potential taxes and fees. Focusing on how a plan is structured and administered gives you important clues regarding the plan’s compliance with 105(h).

Let’s start with how it is structured.

or

Part 1

Section 105(h) of the tax code states that a “self insured medical reimbursement plan” is a plan of an employer to reimburse employees for expenses for medical care for which reimbursement is NOT provided under a policy of accident and health insurance.”

According to the rules outlined, if the plan is a self-insured (or “cost-plus”) type of arrangement, the employer:.

Part 2

Section § 1.105-11 further outlines the taxability question:

(a) In general. Under section 105(a), amounts received by an employee through a self-insured medical reimbursement plan which are attributable to contributions of the employer, or are paid by the employer, are included in the employee’s gross income unless such amounts are excludable under section 105(b)…

This means that the employer:

IT MEANS: Insurance is the key

The law clarifies that “a plan that does not involve the shifting of risk to an unrelated third party is considered self-insurance and that a cost-plus policy or a policy which in effect merely provides administrative or bookkeeping services is considered self-insured for the purpose of this section.” We will review both of these in more detail in another section.

IT MEANS: Cost-plus arrangements (even under a policy of insurance) are considered self-insured.

The IRS code also goes on to state that if only a portion of an employer’s policy is underwritten by insurance, then any benefits provided other than insurance will be considered to be provided by a self-insured plan. For example: If a cost-plus medical reimbursement plan includes fully insured AD&D coverage, only that portion is insurance, not the medical reimbursement portion.

Let’s now turn to the issue of “insurance.” How can an employer know if it is insurance?

While an approved policy in the state of issuance is important for the purpose of insurance regulation, it is not the key to the IRS evaluation. 105(h) is about taxability, not insurance law. Remember, 105(h) states that “a plan that does not involve the shifting of risk to an unrelated third party is considered self-insurance.”

To be considered insurance, there must be realistic risk transfer.

The Supreme Court and Tax Courts defined insurance as needing “adequate risk transfer” and “risk distribution.” Tenth Circuit Court’s decision in Beech Aircraft Corporation vs. United States 979 F.2d.920.922 (1986) defines risk shifting and risk distribution. Specifically, the Tenth Circuit provided: “’Risk shifting’ means one party shifts the risk of loss to another, and ‘risk distribution’ means the party assuming the risk distributes the potential liability, in part among others.”

To meet the risk transfer requirement, a contract of insurance must transfer to the insurer a meaningful and significant possibility of incurring loss.

It can be a challenge to determine if the plan transfers risk since the presentation of potential costs may make it look like there is insurance protection. In the below example it would be a logical conclusion.

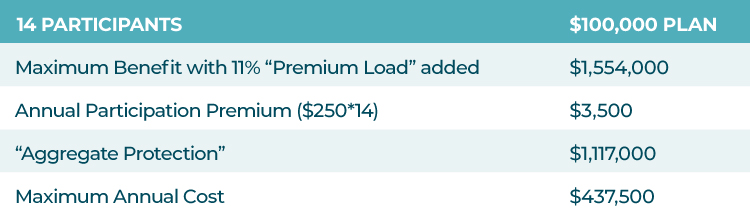

Aggregate protection is difference between maximum annual cost and the maximum benefit (including 11% administrative fee).

In this example, the proposal is making it appear as if there is a substantial amount of risk transfer since the maximum employer cost ($437,500) is so much lower than the total payable benefit with administrative fees added ($1,554,000). However, in reality, it is very unlikely that a group like this would reach the maximum cost threshold, which is the point where the carrier begins to take claims risk. A more normal level of claims for a group of 14 enrolled executives is $137,000*, so it is the employer who ends up funding the claims for the group. In effect, the plan is really structured and administered with little chance of risk transfer, even though, on the surface level, it would appear to be insurance.

This is not local, state or federal tax advice. This material has been prepared for informational purposes only, and is not intended to provide, nor should it be relied on for, tax advice. Each person and each company is unique with their own facts and circumstances. It is recommended that you seek the independent counsel of a professional tax adviser.

Continue reading and download the FREE eBook today

What you need to know about medical reimbursement plans and 105(h) compliance