Taking Healthcare Coverage to the Next Level

Think coverage gaps are just deductibles, coinsurance and co-pays? While these might be the most notable shortfalls, they aren’t the only ones to keep in mind, especially when it comes to taking care of key talent. How can you help your clients close health plan gaps and provide a more targeted boost in benefits to keep top talent healthy, happy and loyal?

Introducing our new open plan designs for Ultimate Health® by ArmadaCare. The robust coverage clients’ love now with more flexibility than ever before, including additional support for mental health and well-being. It not only picks up primary health insurance plan gaps but expands and enhances coverage to eliminate the frustrations and distractions that typically accompany one-size-fits-all core health plans.

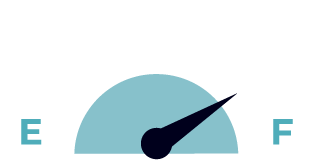

Level 1

Combating Traditional Health Plan Gaps

Initial coverage gaps arise from primary plans that don’t offer sufficient coverage and from cost shifting. Be sure to consider the exclusions and limitations here, especially things like physical therapy visit limits.

HEALTH PLAN GAPS

Picks up where the primary plan leaves off

- Deductibles

- Co-Pays

- Coinsurance

- Exclusions

- Limitations

- Visit Limits (Physical Therapy)

Primary Health Insurance Plan

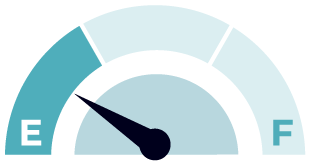

Level 2

Offering Expanded Coverage

Executive healthcare utilization is different and primary health plans typically fall short of their needs. Ultimate Health helps bridge that gap by expanding ordinary coverage to what they want and expect.

EXPANDED COVERAGE

What primary plans used to cover

- Brand Name Frames

- Extra PT Visits

- Private Hospital Rooms

- Brand Name Rx

- Major Dental

- OON Mental Health

HEALTH PLAN GAPS

Picks up where the primary plan leaves off

- Deductibles

- Co-Pays

- Coinsurance

- Exclusions

- Limitations

- Visit Limits (Physical Therapy)

Primary Health Insurance Plan

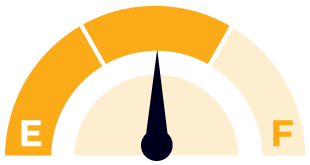

Level 3

Going a Level Beyond with Surprise Coverage

Executive health is an investment, not an expense. That’s why you need coverage for physical and emotional well-being, including treatments to combat stress and powerful preventive services.

ArmadaCare’s Ultimate Health offers robust coverage and behavioral health resources to address the full spectrum of stress, mental health and well being concerns.

A LEVEL BEYOND

Surprise coverage that exceeds expectations

- Acupuncture

- Executive Physicals

- Treatment Abroad

- Adult Orthodontia

- Prescription Sunglasses

- LASIK

- Prescribed Massage Therapy

EXPANDED COVERAGE

What primary plans used to cover

- Brand Name Frames

- Extra PT Visits

- Private Hospital Rooms

- Brand Name Rx

- Major Dental

- OON Mental Health

HEALTH PLAN GAPS

Picks up where the primary plan leaves off

- Deductibles

- Co-Pays

- Coinsurance

- Exclusions

- Limitations

- Visit Limits (Physical Therapy)

Primary Health Insurance Plan

With Ultimate Health® there is robust coverage for a broad range of healthcare expenses, including the routine, the expected and even the unexpected. Now with our new open plan designs, there is more flexibility than ever before so executives and key leaders can use the plans for what they individually need to be healthy and happy.

Proven to drive retention:

Proven to add value:

Sources: ArmadaCare Enrollment Data and Engagement Survey, 2022

Financial efficiency*

Timing flexibility

Implement coverage at the start of any month (there is no need to wait until the primary plan renews)

Employee eligibility

Choose who to offer the plan to based on title, tenure, performance and more (as defined by employer)

Learn how you can take your clients’ health insurance coverage to the next level today.

Get in touch with one of our experts. You choose the time that’s best for you, and we’ll do the rest!

*This is not local, state or federal tax advice as each person and each company is unique. It is recommended that you seek the independent counsel of a professional tax adviser.

The Ultimate Health supplemental health insurance policy is underwritten by Sirius America Insurance Company and Transamerica Life Insurance Company. Premiums, insurance plans, coverage and availability may vary by state. Detailed coverage, exclusions and limitations are listed in the Certificate of Insurance. Please contact us to confirm state availability.