Healthcare That Supports Differences

Obvious fact: Everyone is different.

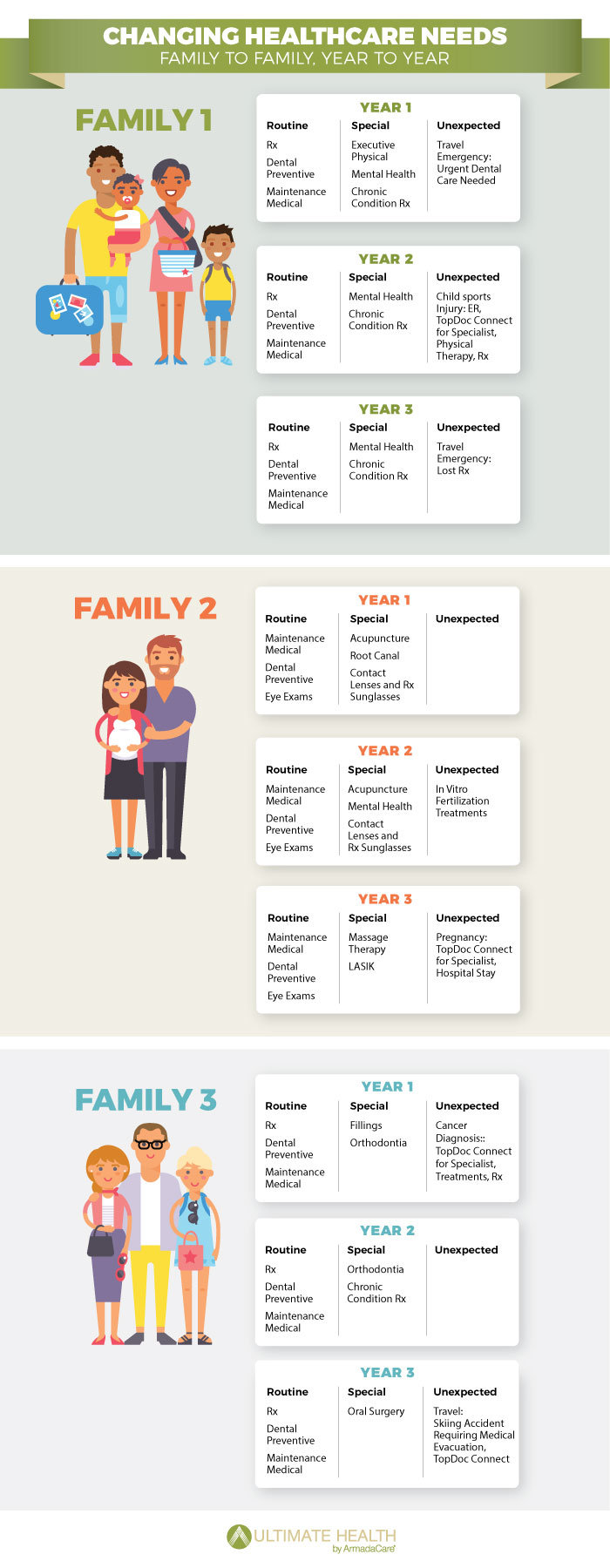

So, you would expect everyone to have different healthcare needs based on who they are: age, family histories, types of environments, rigorous work schedules, etc. Every variable of each person’s life affects their health and, therefore, will affect the kind of healthcare they are going to require. The same goes for each family’s needs.

Similarly, each person’s or family’s needs are not likely to stay the same forever. Life stages affect healthcare needs, and reaching new stages may trigger new needs. For example, you could go from only needing a few prescriptions for a few years, to then requiring chiropractic care after an accident, and then years later needing coverage to get your child braces!

All of this seems pretty self-evident. Needs are different from person to person and family to family, and they change over time. So shouldn’t your healthcare be flexible enough to ebb and flow with your life and health stage needs?

The problem with the health coverage that many are receiving is that it lacks this ability. The primary health insurance market is saturated with one-size-fits-all plans, but obviously one size doesn’t fit all. Health issues often arise that surpass the capabilities of these plans. While they strive to provide homogenized coverage for all, they are leaving most with gaps and holes where the coverage doesn’t extend to their specific needs.

Ultimate Health wants to change this by providing healthcare that is specifically made to be flexible. We know that every person and family will need different things at different points in their lives. Our robust supplemental healthcare plan strives to provide coverage for all different types of health needs that could arise, whether they are routine, special or unexpected. See the chart below for details.

Learn more about Ultimate Health.